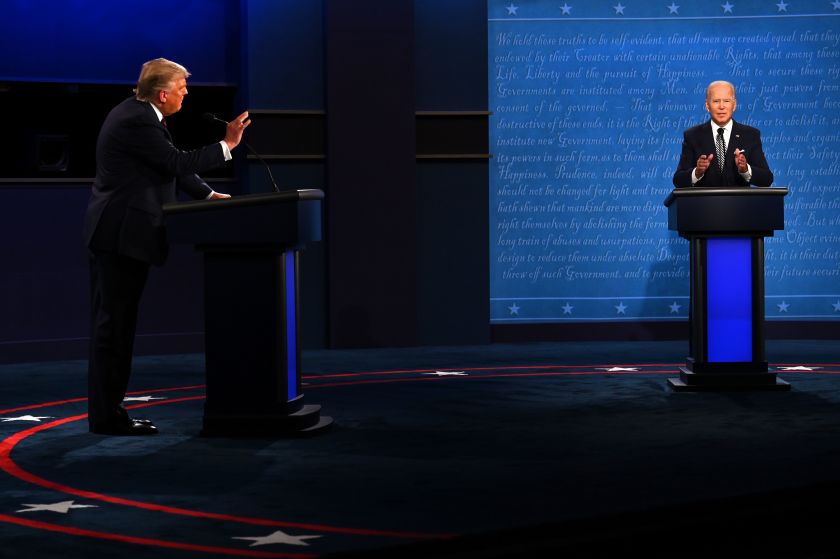

The bitcoin market and global stock markets fell hours after the first presidential debate between US president Donald Trump and candidate Joe Biden ended in chaos.

Bitcoin, the benchmark cryptocurrency, erased most of Tuesday's gains, falling 1.19 percent. Meanwhile, futures linked to the U.S. Standard & Poor's 500-stock index tumbled 0.85 percent, suggesting the New York market will open negative on Wednesday.

Asia Pacific markets, including Australia's ASX 200, Japan's Nikkei and China's Shanghai Composite, also fell. In Europe, futures linked to London's FTSE index fell 0.5 percent.

The broad sell-off in risk markets came as investors expressed concern about the uncertainty surrounding the US presidential election. Their negative sentiment stems from Mr Trump's assertion of "widespread voter fraud" and his claims to challenge the election results.

Fears of disputed elections have pushed up the VIX index, a barometer of market uncertainty. The index gives you an idea of what the market expects to see in the next 30 days (because you only have expectations of the market before volatility happens). Because the VIX is often used to assess future risks, it is also known as the fear index.

Now, economists, strategists and analysts are predicting that the VIX will rise further ahead of the election, which could lead to a short-term sell-off in stocks.

Mark, chief investment officer for global wealth management at UBS. "By suggesting that he will actively debate the outcome in the weeks after the votes are counted, [Mr Trump] has increased uncertainty among market participants and could lead to more volatility as election day approaches," said Mark Haefele, chief economist at Ubs.